In this article

How can I be verified as an accredited investor?

What is an accredited investor?

An accredited investor is a person or a business entity who can invest in securities not registered with financial authorities. They are entitled to purchase these securities if they satisfy one (or more) requirements regarding income, net worth, asset size, governance status or professional experience. These requirements are governed by Regulation D of the Securities Act of 1933, and the U.S. Securities and Exchange Commission (SEC), who regulate the securities industry in the United States.

In general terms, an accredited investor must have an annual income exceeding $200,000, or $300,000 for joint income, or a net worth exceeding $1 million - either individually or jointly with their spouse.

Which Steward investment options require investors to be accredited?

US Residents

- You do not need to be accredited to invest in the Steward Farm Trust, unless you reside in Florida or Nebraska

- You do need to be accredited to invest in an individual farm if it is located in a different state than where you reside

- You may not need to be accredited to invest in an individual farm if it is located in the same state that you reside in

Non-US Residents

- You do need to be accredited to invest in the Steward Farm Trust

- You do need to be accredited to invest in an individual farm

How do I verify myself as an accredited investor?

During the Steward investment process, eligible investors will be required to submit the following form to verify their Accredited Investor Status:

📁 Download the Accredited Investor Form 506C, here

Once completed, you can upload your verification form to your Steward Profile.

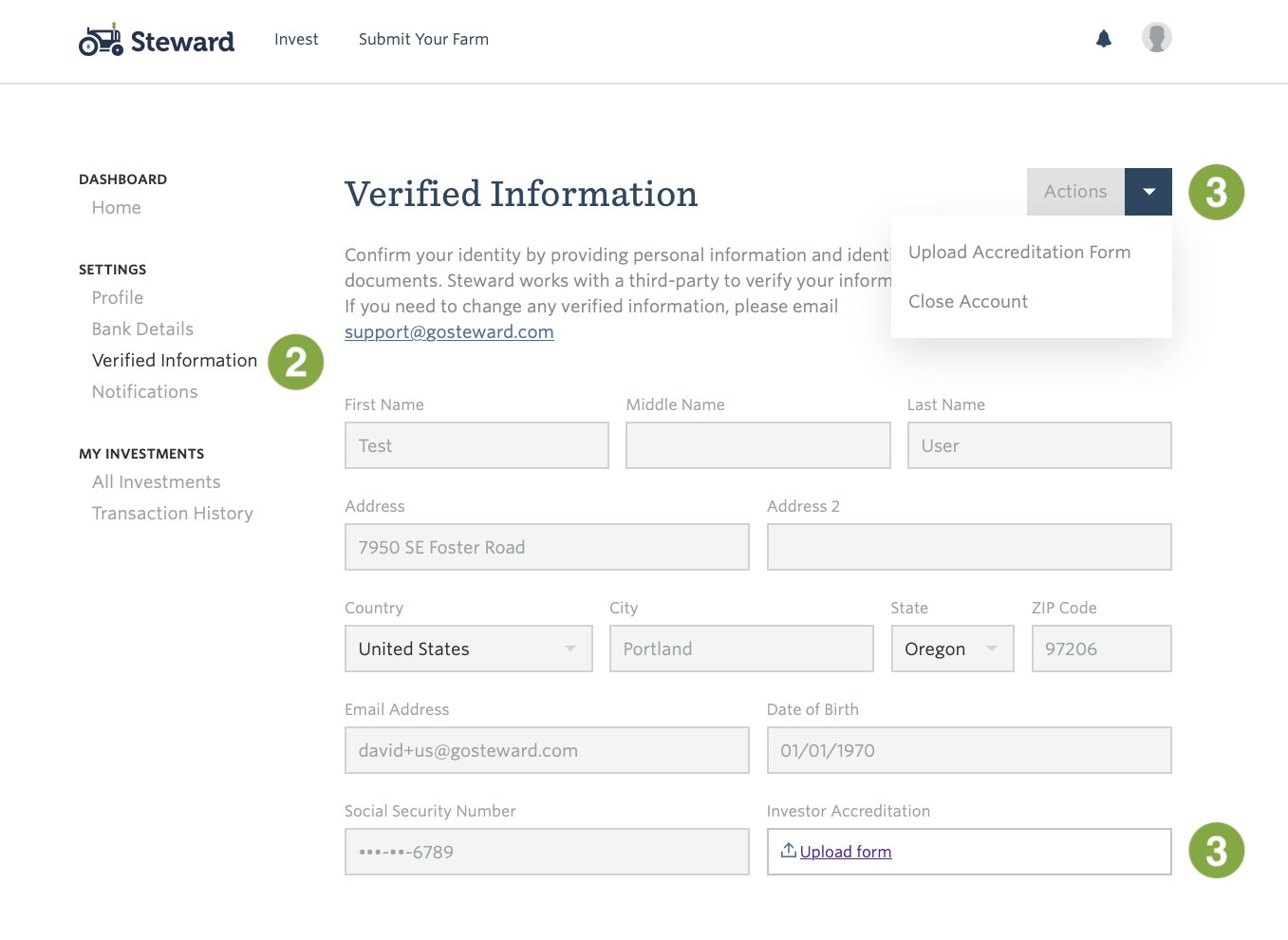

- Log into your account on the Steward website

- On your Steward Dashboard, under Settings, click Verified Information

- Upload your form either from the drop-down menu, or in the Investor Accreditation field

As this is an SEC requirement, your document will have to be verified by one of the below people:

- A certified public accountant who is duly registered and in good standing under the laws of the place of his or her residence or principal office.

- An investment advisor registered with the Securities and Exchange Commission.

- A licensed attorney who is in good standing under the laws of the jurisdictions in which he or she is admitted to practice law.

- A registered broker-dealer.

Alternative methods of verification

If the above method of verification is not available to you, Steward may accept the below documentation to verify that you meet accredited investor criteria.

Proof of income for the two previous years

Steward can assess that you are an accredited investor on the basis of income if you submit any IRS form that reports your income for the two previous years (including, but not limited to, Form W-2, Form 1099, Schedule K-1 to Form 1065, and Form 1040) or a similar payroll document in your country of origin. You will also need to provide confirmation that you have a reasonable expectation of reaching the required income level (as outlined above) during the current year.

Proof of net worth for the three previous months

Steward can assess that you are an accredited investor on the basis of net worth by reviewing one or more of the following types of documentation, dated within the prior three months. You will also need to provide written confirmation that all liabilities necessary to determine your net worth have been disclosed.

Proof of assets

Bank statements, brokerage statements and other statements of securities holdings, certificates of deposit, tax assessments, and appraisal reports issued by independent third parties.

Proof of liabilities

A credit report from at least one of the nationwide consumer reporting agencies.