In this article

- Who is Steward Lending?

- Is Steward Lending a bank?

- In what ways is Steward different from a traditional lender, like my local bank?

- What is a “participated loan” and how does it work?

- Can I get a loan for any reason?

- Do you operate in all 50 US states?

- Are people in my community lending me money directly?

- Am I selling stocks in my business or issuing bonds?

- What about security for my loan? What if I can’t repay it?

- What collateral do you require to secure my business’s loan?

- Can anyone purchase loan participations from Steward to support my loan?

- Is it up to me to find all of these participating lenders?

- What do I tell people about participating in my loan?

- Is this Crowdfunding?

- Is this a donation? Is it tax-deductible?

- Am I responsible for repaying the participating lenders?

FAQ Participated Loans - Borrowers

- Who is Steward Lending?

- Is Steward Lending a bank?

- In what ways is Steward different from a traditional lender, like my local bank?

- What is a “participated loan” and how does it work?

- Can I get a loan for any reason?

- Do you operate in all 50 US states?

- Are people in my community lending me money directly?

- Am I selling stocks in my business or issuing bonds?

- What about security for my loan? What if I can’t repay it?

- What collateral do you require to secure my business’s loan?

- Can anyone purchase loan participations from Steward to support my loan?

- Is it up to me to find all of these participating lenders?

- What do I tell people about participating in my loan?

- Is this Crowdfunding?

- Is this a donation? Is it tax-deductible?

- Am I responsible for repaying the participating lenders?

At Steward, we strive to offer a straightforward and compliant means for regenerative agriculture businesses to access flexible loans. We appreciate that Steward's lending model may be unfamiliar to many, so we've outlined answers to some of Steward's most commonly asked questions below. We hope these help!

Who is Steward Lending?

Steward Lending LLC is a non-bank financial institution that acts as a private commercial lender exclusively to support regenerative agriculture businesses. Our parent company, Steward Holdings (US) Inc., is a public benefit corporation and a certified B Corp. This means we consider more than just profit when making decisions, instead ensuring our works aligns wholly with Steward's mission: to promote economic and environmental stewardship through regenerative agriculture.

Is Steward Lending a bank?

Steward Lending is not a bank. As a private commercial lender, Steward makes business loans to entities such as yours that are exclusively commercial in nature. We don’t lend money for people to buy homes, nor do we extend credit to individuals who may just need money. We don’t lend money to farms & ranches that want to buy agricultural land that has a residence on it. We also do not take deposits.

In what ways is Steward different from a traditional lender, like my local bank?

- Flexibility: We believe in customization, not cookie-cutters. Steward offers flexible terms on the business loans we make, from setting the interest rate to providing a deferment period after the loan is disbursed so the funds can be used to generate revenue before starting to make repayments. We are able to customize each loan's term and structure based on the unique financial circumstances of each borrower. This is fundamentally different from traditional financial institutions where they often only offer set financial product with little to no room for customization.

- Growth: The opportunity is in what lies ahead. We lend to support the future potential of the business (acquiring land, infrastructure, equipment and operational improvements), providing a pathway to grow and scale, whereas most traditional finance is only lending based on historical cash flow.

- Values: Steward Holdings (US) Inc., a Public Benefit Corporation (B Corp), is a mission-driven entity that supports regenerative agricultural practices and takes into account values and positive externalities when making underwriting decisions. Things that not only we value, but are important to our impact-minded lender community. Our primary purpose is to make loans that advance regenerative agriculture businesses, the resilience of local communities, and the health of the environment.

- Diversity: We take a much broader perspective on the agricultural businesses and products we support, including niche growers and heirloom varietals, heritage breeds of livestock, and other natural products, whereas most traditional agricultural funding is solely limited to the major commodities.

- Advisory Services and Sector Expertise: Each loan application is vetted by a seasoned farmer who works for Steward, so that during our diligence process the loan candidate can explain their business, production, and opportunities for growth to someone who actually understands farming. Each borrower has ongoing access to the expertise of the "Farm Steward" and other paid add-on Services, such as bookkeeping, grant writing, marketing, and e-commerce support.

What is a “participated loan” and how does it work?

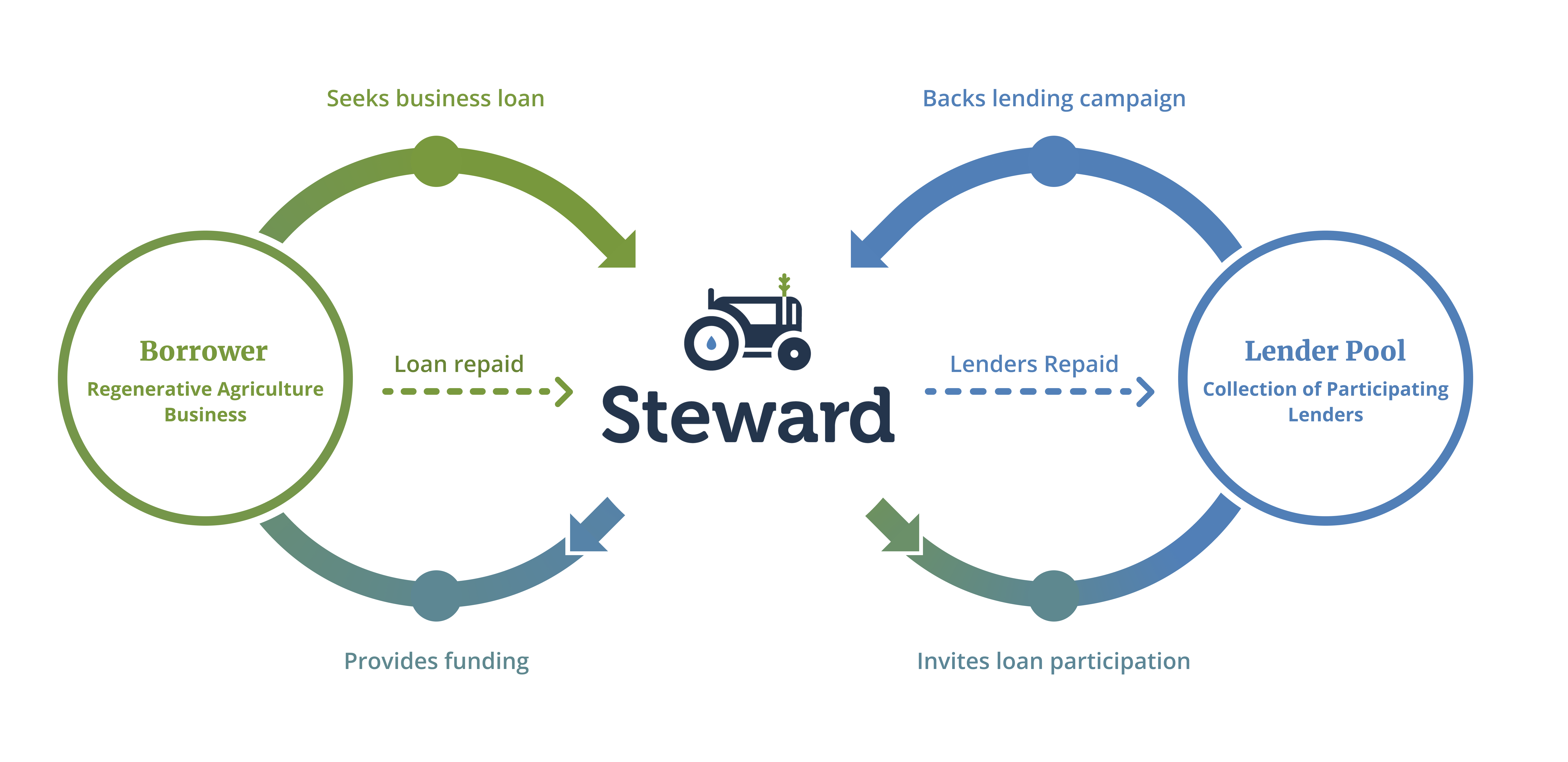

A participated loan is a recognized commercial lending structure. Steward makes loans to individual agricultural businesses, like yours, for specific commercial purposes. To support Steward, qualified individuals (those who regulators specify as “appropriate or sophisticated lenders”) can buy a “piece” of the loan that Steward is making. These supporters are referred to as “participating lenders,” and they are buying a “loan participation” in your lending campaign.

Can I get a loan for any reason?

No. Steward is a private commercial lender. This means we lend money exclusively to businesses and only for specific purposes. Most of our loans are intended to be used to purchase specific business assets, such as land, infrastructure, or equipment (e.g., tractor, hoop house, refrigeration, etc.), and in certain cases, for operations. Our loans may not be used for spending that is not related to your agricultural business. That’s called consumer lending, and it's not what we offer at Steward.

If you plan to use a loan from Steward to purchase agricultural land with housing on it, the housing must related to the agricultural use (e.g., farm owner/worker housing), and depending on the state there may be additional restrictions.

Contact us if you have questions about your planned use of funds and whether they may qualify for a loan from Steward.

Do you operate in all 50 US states?

Nearly, but not yet! We do operate in most states and are always looking to expand. To find out if we offer lending in your state, contact us at support@gosteward.com

Are people in my community lending me money directly?

No, not exactly. The only one lending you money is Steward. Those in your community are supporting your project by participating in a loan with Steward. Then, in turn, Steward supports you by providing the business loan. Participating lenders are purchasing a piece of a Steward loan. Participating lenders do not have any direct financial relationship with you or your business (their financial relationship is with Steward). Further, those who are participating in your loan are not “investing”, no more than a bank that holds your home mortgage is an “investor” in your home. However, we definitely encourage our participating lenders to support your business by purchasing your products!

Am I selling stocks in my business or issuing bonds?

Neither. Stocks and bonds are referred to as “securities,” which are general investment vehicles in a particular company and regulated by the Securities and Exchange Commission (SEC). Our loans, in contrast, are secured commercial loans directed to a specific lending community. They are not securities and the participants are not shareholders.

What about security for my loan? What if I can’t repay it?

All of Steward’s loans are secured. A secured loan means that your business, as the borrower, has to “put up” collateral to secure repayment of your loan. Just like any other loan, this means that if your business were to default on their loan, Steward would have access to specific business assets to ensure we have the funds to make repayments to participating lenders. Secured loans are the norm, providing a level of comfort to participating lenders that there are funds available to make repayments on the loan they're backing.

Steward has a team that works with borrowers throughout the duration of their loan. While we do take a security interest and collateral for the loans, our first approach when a borrowing business is struggling to repay their loan, is to work closely with them on their business plan, explore new markets, find new opportunities, and partner with them to get them back on the path to meeting scheduled repayments.

What collateral do you require to secure my business’s loan?

The short answer is that it depends. When you apply for a loan from Steward, our team will work with you to evaluate your available business assets and determine what sort of collateral is most appropriate for your loan. We are flexible on this approach and will work with you to find a structure that makes sense while providing confidence to participating lenders in the risk of our loans.

Can anyone purchase loan participations from Steward to support my loan?

Many people can, but not just anyone. Participating in a Steward loan is only right for certain people. These purchasers may be institutional buyers (such as a bank) or private buyers (such as a private equity fund). Individuals identify themselves as sophisticated lenders can also purchase a participation in the loan.

Sophisticated lenders is a term for individuals who are familiar with financial transactions, are able to understand the risks of entering into a loan transaction such as this, who have the financial capacity to participate, and can bear the potential loss of their loan principal. No loan repayment or anticipated proceeds are ever 100% guaranteed; all lending involves assumed risk. But Steward goes to great lengths to ensure that any risk is minimized as much as possible to protect participating lenders. Individual participants certify to us upon checkout that they meet this criteria and are a sophisticated lender. Above all, the primary criteria for becoming a participating lender is the motivation to support the growth of regenerative agriculture.

Is it up to me to find all of these participating lenders?

Nope. We manage the contractual relationship with the participating lenders. That said, we generally lend to agriculture businesses that are well established and have a strong network of community support. We want to encourage general participation in the regenerative farm & food products movement, and we believe that for businesses to be sustainable and successful, they need local community involvement. Therefore, we do ask our borrowers to secure some participating lenders from their network and community (see private campaign period).

What do I tell people about participating in my loan?

Because we’re dealing with a regulated financial product, we want to make sure that any messaging around it is clear and accurately describes how our loans are structured. For this reason, we’ll put together a “Marketing Toolkit” to share with you that provides sample messages and templates to communicate with your network. In order to ensure a concise and compliant message, we kindly ask that you stick to our toolkit when promoting your project. If anyone has any questions you feel you can’t answer about Steward or your lending campaign, just send them to gosteward.com. You can also email us at support@gosteward.com.

Is this Crowdfunding?

No. Crowdfunding implies investment in a business through an online offer of securities. This generally means multiple individuals or institutions are buying stock in your business on an approved platform through an offering that has been approved by the SEC. Steward only deals in private commercial loans at this time. Because there are many participating lenders in each of our loans, it's often confused that this is a form of “crowdfunding”. The participating lenders in our structure are just that⏤lenders not investors. They’re not buying a share of your business; they’re just participating in a secured, interest-bearing loan with Steward (who will use those funds to make a business loan to you).

Is this a donation? Is it tax-deductible?

This is NOT a donation or gift. This is a loan that someone makes to Steward and then like any loan, we pay them back with interest over time. As a participating lender, they will receive a monthly loan repayment from Steward each month (after a deferment period) for the duration of the loan term.

Steward is not a 501(c)(3) charitable organization, but we do have one⏤we call it The Steward Foundation! If you’re interested in making a tax-deductible donation to support regenerative agriculture, please contact us at support@gosteward.com to learn more about The Steward Foundation.

Am I responsible for repaying the participating lenders?

No, your responsibility is to repay Steward per our loan agreement. As your lender, we’ll handle repayments we’re required to make to any participating lenders pursuant to our separate loan contracts with them.