In this article

- What types of agriculture businesses does Steward work with?

- What types of projects do Steward loans fund?

- What are the loan amounts that Steward offers?

- Does Steward have standard loan terms?

- What fees are involved?

- What types of commercial entities does Steward lend to?

- What are Steward's primary lending criteria?

- Does Steward work with beginning farmers and other producers?

- How are Steward loans structured?

- What types of documents and information will I need for the loan application process?

- What does the process involve to receive a Steward loan?

- How long does it take to receive my Steward loan?

- What is Steward's mission?

- Why partner with Steward versus raising capital independently?

Receiving a commercial loan from Steward - FAQs

- What types of agriculture businesses does Steward work with?

- What types of projects do Steward loans fund?

- What are the loan amounts that Steward offers?

- Does Steward have standard loan terms?

- What fees are involved?

- What types of commercial entities does Steward lend to?

- What are Steward's primary lending criteria?

- Does Steward work with beginning farmers and other producers?

- How are Steward loans structured?

- What types of documents and information will I need for the loan application process?

- What does the process involve to receive a Steward loan?

- How long does it take to receive my Steward loan?

- What is Steward's mission?

- Why partner with Steward versus raising capital independently?

What types of agriculture businesses does Steward work with?

A wide range of human-scale fruit & vegetable farms, livestock (animals, poultry, eggs, etc.), seafood & aquaculture, food & textile products, value chain & food system infrastructure businesses.

What types of projects do Steward loans fund?

Equipment, infrastructure, land purchase.

What are the loan amounts that Steward offers?

Loans range from $100,000 to $5,000,000+ (largest loan to-date $2.86m).

Does Steward have standard loan terms?

Each loan is tailored to fit the unique financial need of each agricultural business. The full loan term ranges from 36-60 months (sometimes longer) with interest rates most commonly around 6.5%-8.5% depending on the purpose of the loan and the state of the business. All interest is passed on to the individual participating lenders (not Steward). Loan repayment typically begins 3-6 months after funds are disbursed to the borrower.

What fees are involved?

Steward charges a one-time 3% origination fee on every participated loan at the time that funds are dispersed. Other fees may be required as part of our diligence process depending on the nature of the loan.

Additionally, it is important for borrowers to understand that this is a loan and not a donation. All loans must be repaid with interest based on the loan agreement signed by the borrower and Steward.

What types of commercial entities does Steward lend to?

In order to be eligible for a Steward loan, businesses must be set up as one of the following types of businesses: limited liability company (LLC), partnership, corporation (INC).

What are Steward's primary lending criteria?

- 3+ years of agricultural experience

- U.S. business in good standing

- Incorporate regenerative and sustainable practices

- Securable business assets (e.g., land, equipment, inventory, etc.)

Does Steward work with beginning farmers and other producers?

In order to be eligible for a Steward loan, your project must be self-sustaining and meet our regenerative practices criteria. Additionally, Steward prioritizes agricultural businesses with a history of strong annual revenue and applicants with at least 3 years of relevant management experience.

How are Steward loans structured?

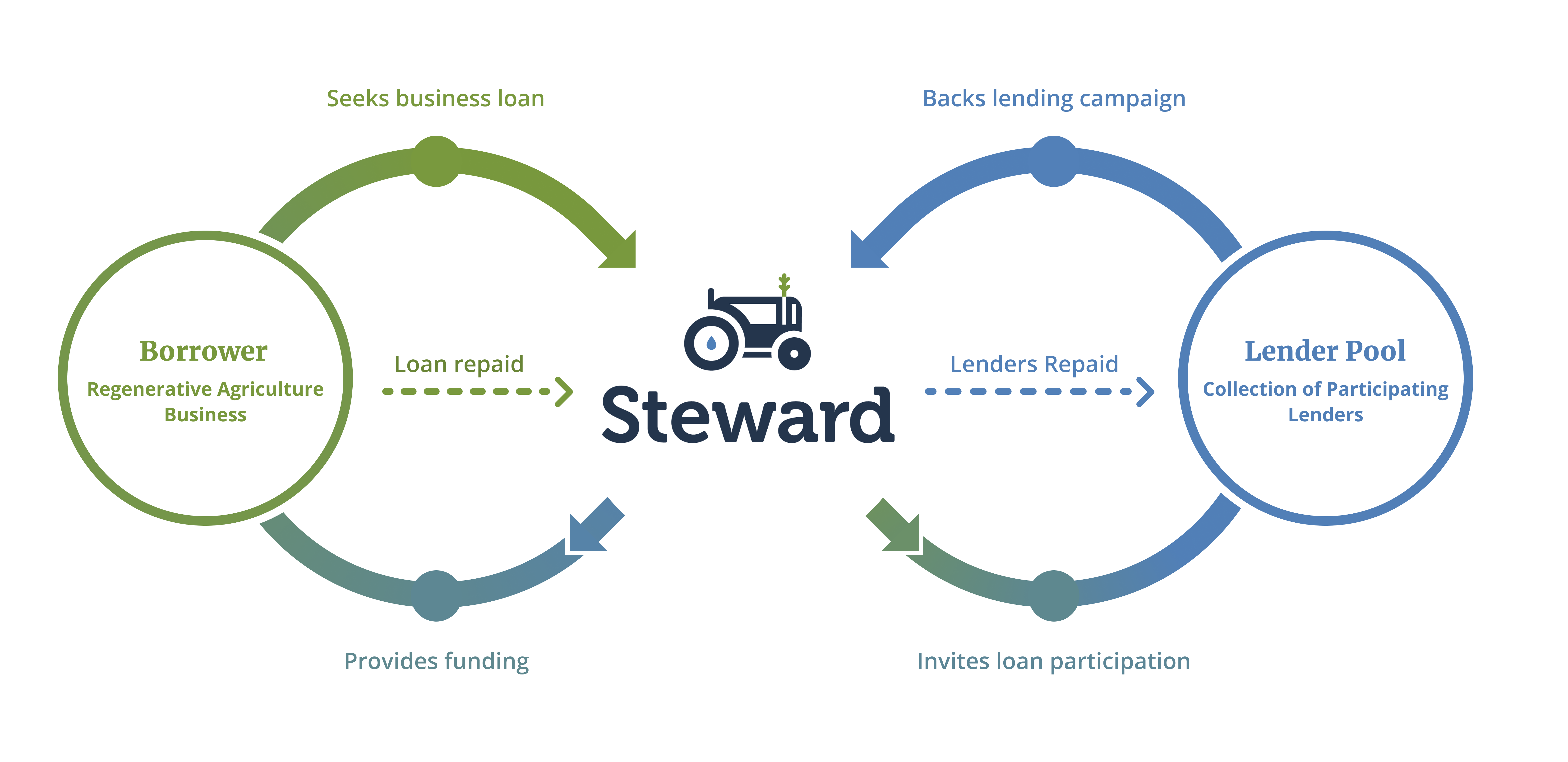

When a regenerative business is in need of a loan, after meeting Steward’s initial requirements (noted above), we work together to determine the right loan size, terms, and how it will be secured⏤all based on the business’s unique need.

Once a loan agreement is signed, the borrowing business partners with Steward to raise the necessary loan funds via a lending campaign on our platform. Together, Steward and the borrower seek participation in the loan from appropriate lenders, allowing such individuals and organizations to buy a "piece" of a loan with Steward that supports your project⏤starting at $100. Once Steward raises the target loan amount, we issue the business a commercial loan and they're off to grow their operation!

What types of documents and information will I need for the loan application process?

Here at Steward, we recognize that every agricultural business is different. That’s why our loan application process is designed to hear your story, understand your business situation, and determine if we can find a financial solution that can help you grow or sustain your operation⏤while ensuring you will be able to repay your loan over time.

Throughout Steward’s loan review & approval process, we may request the following documents:

- Previous 3 years of business tax returns

- Business plan

- Future projected revenue

- Purchase commitments

- Business registration documents

- Other documentation that help us assess the health of your farm business.

Remember, when applying to Steward you are applying for a commercial business loan. Be sure to have your finances in order and be ready to answer questions about your experience and plan to grow your business.

What does the process involve to receive a Steward loan?

- Apply: Complete the online loan application, telling us more about your business and financial needs.

- Approval: Work with the Steward team to confirm loan terms and plan for your lending campaign on Steward’s platform.

- Private Phase: Start by sending emails and making phone calls to invite qualified “anchor lenders” in your network to participate early in your campaign. This helps to build momentum.

- Public Phase: Once a campaign reaches a certain percentage funded (typically 20%), the campaign "goes public" and is featured on Steward’s website. From here out, we will co-promote the campaign together with outreach to prospective lenders in your community, as well as Steward's lender network.

- Receive Funds: After a successful campaign, Steward will finalize its loan to your business by disbursing funds through our secure online lending platform.

- Grow: Expand your business and share your success! Begin repaying your loan to Steward after an agreed-upon deferment period (typically 3-6 months, sometimes longer). At that point, Steward will automatically begin repayments to all participating lenders in your project.

*NOTE: Loan terms can be adjusted to meet specific needs.

How long does it take to receive my Steward loan?

Once your project is approved by Steward, receiving your loan is dependent on Steward raising the funds by offering appropriate lenders the opportunity to participate (e.g., buy “pieces” of a loan with Steward that helps support your project). The amount of time it takes to reach the loan funding goal depends on the size of your loan, a lender’s perceived quality of your business, and your involvement in the process to engage appropriate “anchor lenders” in your network. Once the target funding amount is raised and all funds are received by Steward, we issue your loan funds in as little as 2-3 business days (typically through an ACH transfer to your designated checking account).

What is Steward's mission?

Steward's mission is to promote economic & environmental stewardship through regenerative agriculture. By financing the growth of farms and food producers directly, Steward strives to meet society’s growing food needs without compromising the planet’s ecosystems, ultimately having the following impacts:

- Preserving natural resources & reducing environmental impacts

- Improving soil health & increasing biodiversity

- Increasing carbon sequestration linked to climate change

- Protecting water quality and abundance

- Promoting local jobs with fair, living wages

- Increasing the number of diverse, under-represented producers

Why partner with Steward versus raising capital independently?

Regenerative agriculture businesses choose to partner with Steward because our lending process is specifically designed to help them grow. We hear that partnering with Steward is a lot different than the experience of working with a bank or government program. A few things really set us apart:

- Flexibility⏤Each loan is tailored to your business, making it easier for you to increase revenue and profitability.

- Focus on Regenerative Agriculture⏤Our team understands the seasonality of farming and food production, so we can craft a loan that works for you.

- Innovative Lending Model⏤The Steward platform creates an opportunity to engage your customers and community in a new way.

- Values-aligned⏤We believe in your mission and we will never compromise on ecology or community.